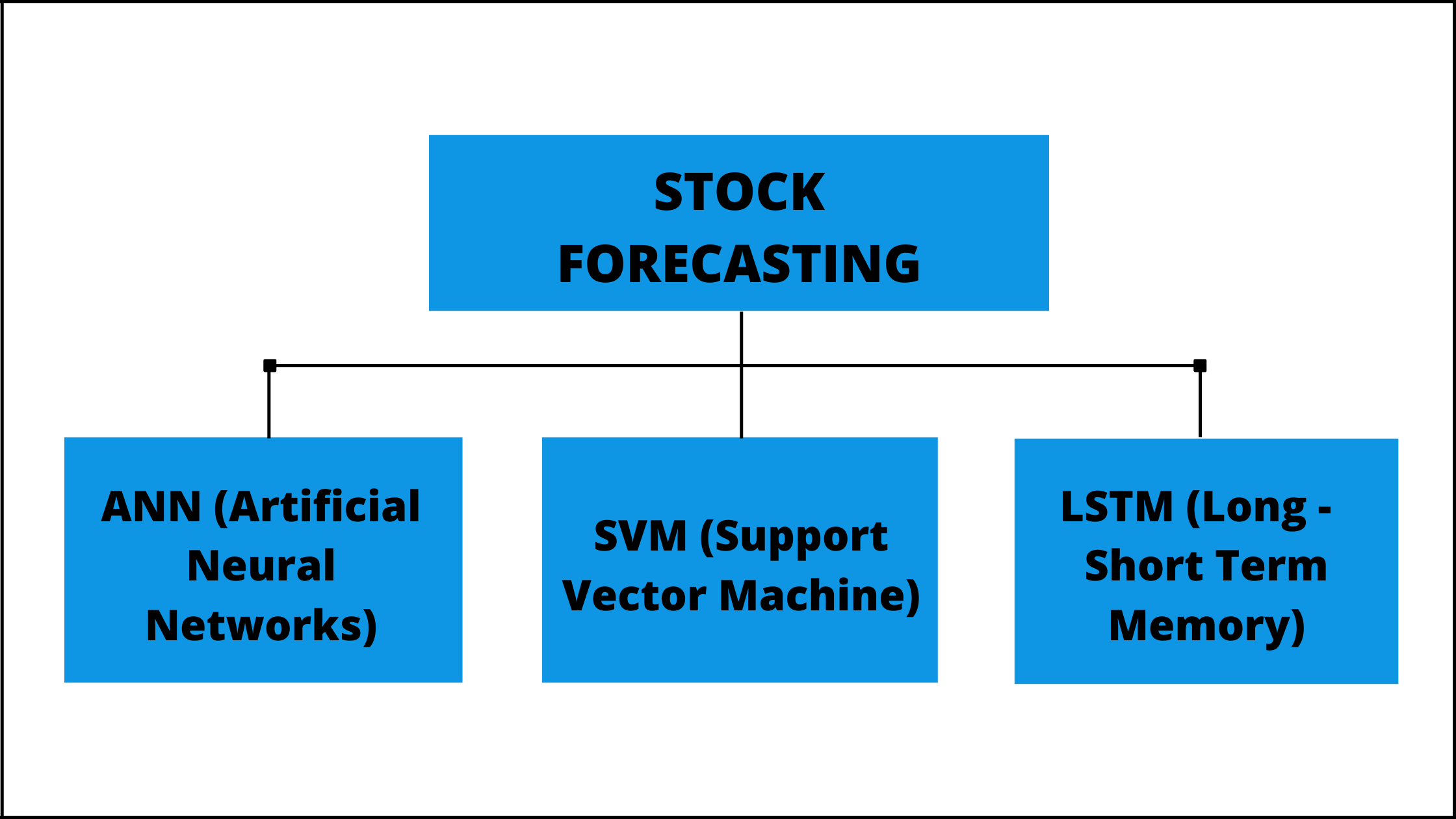

Diverse researchers have presented several techniques to predict the stock market. In this, a technique based on Machine Learning is suggested for predicting the stock market with the help of different models, namely Long-Short Term Memory (LSTM), Support Vector Machine (SVM), and Artificial Neural Networks (ANN). The presented work has analyzed this technique to attain the advantages of implemented models for the effective prediction of the stock market. There are some steps followed in these models, which are:

- Dataset Input: The first step is presented in which the data is added to these models. Subsequently, we concentrate on pre-processing the data in which the major issue related to class imbalance is faced. However, to resolve this problem, the time series dataset is effectual.

- Data Analysis: The next step is to analyze the data, in which the stock market data is analyzed and illustrate the analyzed data in a graphical form for investigating the impact on the prices.

- Data Segmentation: This step focuses on dividing the dataset into training and testing sections. Thereafter, the regression models are implemented for predicting the stock market.

- Performance Analysis: The last step is deployed for computing the performance of the implemented models in terms of Mean Square Error (MSE) and Root Mean Square Error (RMSE).

These steps are utilized in the suggested technique while predicting the stock market effectively. The data is gathered from the Yahoo finance which is the extensively exploited API. The implementation of the suggested Machine Learning approach is done in Python. The results depicted that the suggested technique is more effective as compared to others.